Personal Tax Relief 2024 Status – The aim of tax-exempt status is to support organisations that engage in activities that benefit the public or fulfill certain social or charitable purposes. . Beginning February 13, 2024, hundreds of thousands of Michigan residents will benefit from a $550 check in their mails. The checks are part of the $1 billion in tax cuts that Gover .

Personal Tax Relief 2024 Status

Source : www.linkedin.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

More than 700K Michigan households getting tax credit checks in 2024

Source : www.clickondetroit.com

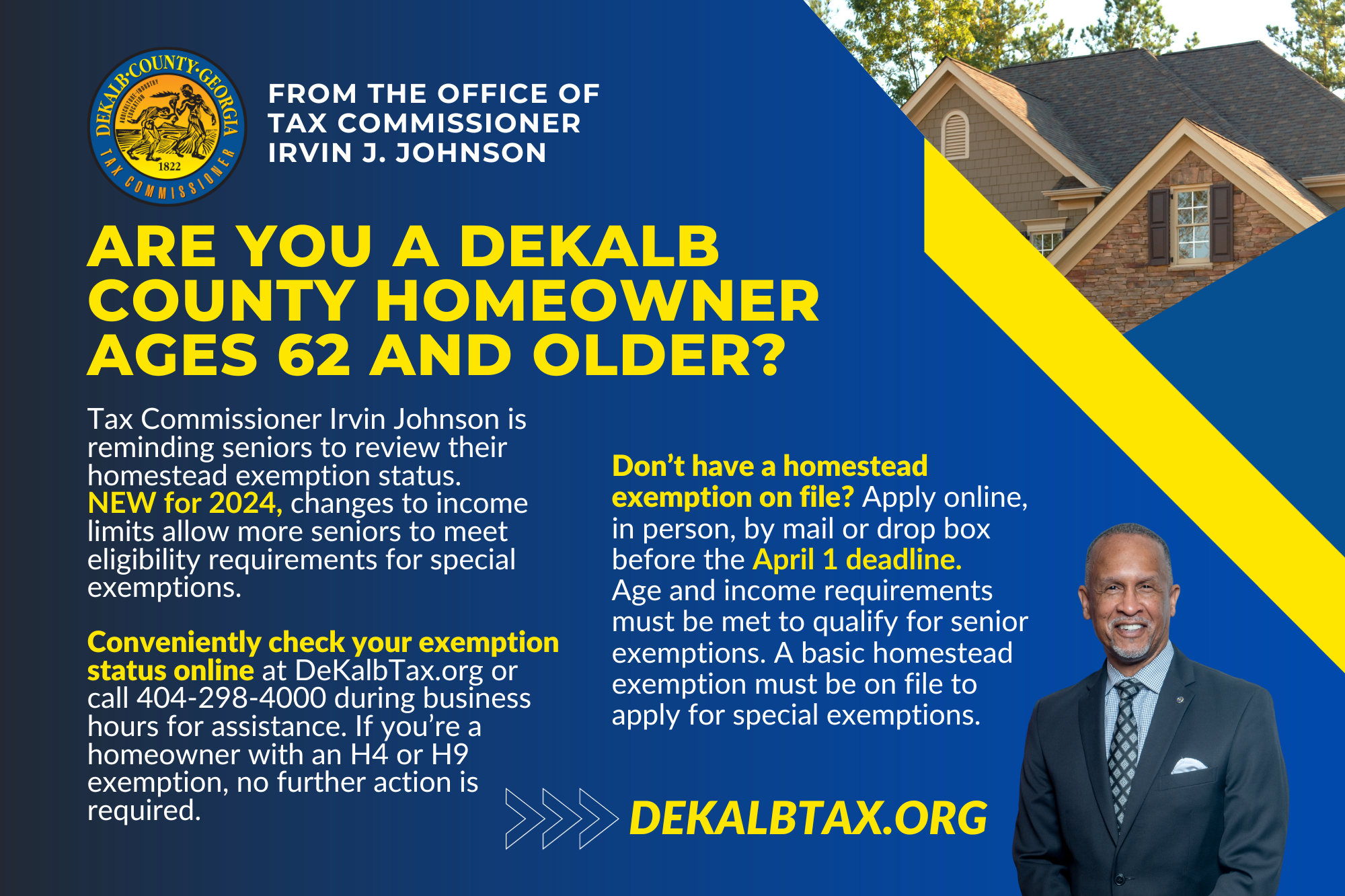

File for Homestead Exemption | DeKalb Tax Commissioner

Source : dekalbtax.org

Kelly, bipartisan contingent of legislators promote multiyear $1

Source : kansasreflector.com

2024 IRS Tax Brackets and Standard Deductions Optima Tax Relief

Source : optimataxrelief.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

The (Pretty Short) List of EVs That Qualify for a $7,500 Tax

Source : insideclimatenews.org

$600 Earned Income Tax Credit 2024 Know Income Limit & EITC

Source : cwccareers.in

Tesla Model 3 RWD and Long Range tax credits reduced for 2024

Source : www.teslarati.com

Personal Tax Relief 2024 Status altHR on LinkedIn: Income Tax Reliefs That Might Not be Available : The IRS expects nearly 129 million individual tax returns to be filed by the April 15 deadline. Here’s what you need to know. . ET Wealth reached out to experts from different fields to understand their expectations Also Read: Income Tax in Budget 2024: Will standard deduction In this backdrop, there is little hope of any .